Shanghai is entering its second week of full lockdown (Pudong, the eastern half, started on March 28; Puxi, the western half, on April 1) and though there is some partial improvement for some communities, things will take time.

The food & beverage industry in Shanghai, and of course in China, is widely impacted (you can refer to last week’s newsletter to have a good grasp of the whole situation), and usual trends have shifted.

In this week's newsletter, against all odds, I managed to identify new trends in China, but there are also other lessons to take now so we are ready for what comes next.

— Greg

If you’d like to know more about what Shanghai is going through, reach out to me or leave a comment.

Hi, I’m Greg, founder of NextStep [F&B] Studio. We help F&B brands and companies in China grow by implementing new F&B trends & innovations.

The FoodTech Confidential Newsletter is my way to share what’s happening in the Food and Beverage industry with F&B professionals, FMCG experts, Tech entrepreneurs, and Investors with a focus on China and Greater Asia. Contact greg@nextstepstudio.co.

TODAY’S SPECIALS

1 - “Group-Buying” is probably not the future, but it’s definitely here today.

2 - Time for the robots to rise

3 - e-groceries taking all the funding

4 - Time for restaurants to upgrade their digital experience

WHAT’S NEW DURING LOCKDOWN?

1 - Group-buying overtakes Meituan and Eleme on-demand delivery

During the Shanghai lockdown, deliveries are very difficult: a lack of people authorized to work from their shop, a lack of supplies that can enter Shanghai, and a lack of delivery persons. So residents have been jumping on WeChat to arrange group buying (团购 tuángòu) with other residents at the same address to bulk-buy groceries from suppliers or restaurants, placing single orders that could add up to thousands of dollars.

“Restaurants such Yum China's Pizza Hut and hot pot chain Haidilao, which have had to shut their dine-in outlets, have jumped on the bandwagon. The former at one point had offered groups of 10 buyers 120 steaks for 2,900 yuan ($456). The latter has sold packages of eggs, mushrooms, and root vegetables priced at 58 yuan with a minimum order of 30 sets.” (reuters)

People are using the super app WeChat and different mini-program to arrange their orders with their community.

“Limited numbers of couriers on the streets mean that delivery apps like Meituan and Alibaba are struggling to fulfill orders. Groups on the popular messaging service WeChat are trying to solve the problem by combining individual requests into one giant order to serve a building or even a whole neighborhood. Each group chat focuses either on orders from a particular store or for an individual item: there are groups for everything from eggs, fruit, and milk to pet food, coffee, and Coke, Shanghai residents told Rest of World. Members will also individually trade goods like diapers and soy sauce. Shared spreadsheets have sprung up to collect orders for whole neighborhoods and direct buyers to the correct groups. The guards at the entrances of each neighborhood, there to ensure that nobody enters or exits, sometimes deliver the goods to apartment doors themselves.”

The Shanghai government has issued "green passes" for businesses considered essential to the city's operation, so merchants with the passes can also help deliver essentials to local communities while being watched and controlled and have to abide by pricing regulations, provide commodities and services at reasonable prices, and maintain normal market pricing.

But with cases growing fast every day, people are afraid this practice could be stopped since it also could be a way for the virus to spread.

In the meantime, if you’d like to deep dive into how the WeChat group-buying app works and what it looks like, visit SmartShanghai and their step-by-step tutorial. This will give you a good idea of an additional service to offer your clients who are concerned with the flipside of on-demand deliveries.

2 - Now would be a good time to launch those robots

On one hand, you have 26 million people on lockdown in Shanghai who are all trying to get their groceries delivered to their building at least (security guards and volunteers are usually dispatching the deliveries from the compound gates to the door of the buyer).

Now the problem is, as mentioned earlier, there are like 11,000 deliverymen for millions of orders every day. Fees are off the charts (10 times what you should pay), and also very slow. Volunteers and drivers are overworked and are now running around to handle the last-mile delivery, while potentially taking risks.

The consequence of having everyone locked at home is that roads are empty…

Wouldn't it be great to take the delivery robots that everyone has been talking about out for a ride?

In some of the compounds in Pudong that have a high number of positive cases, Meituan has deployed its fleet already but it’s still an opportunity for the rest of the city.

WHAT’S NEW OUTSIDE OF LOCKDOWN AND IN THE REST OF THE WORLD?

3 - Over a third of 2021 agrifoodtech investment went to e-grocers

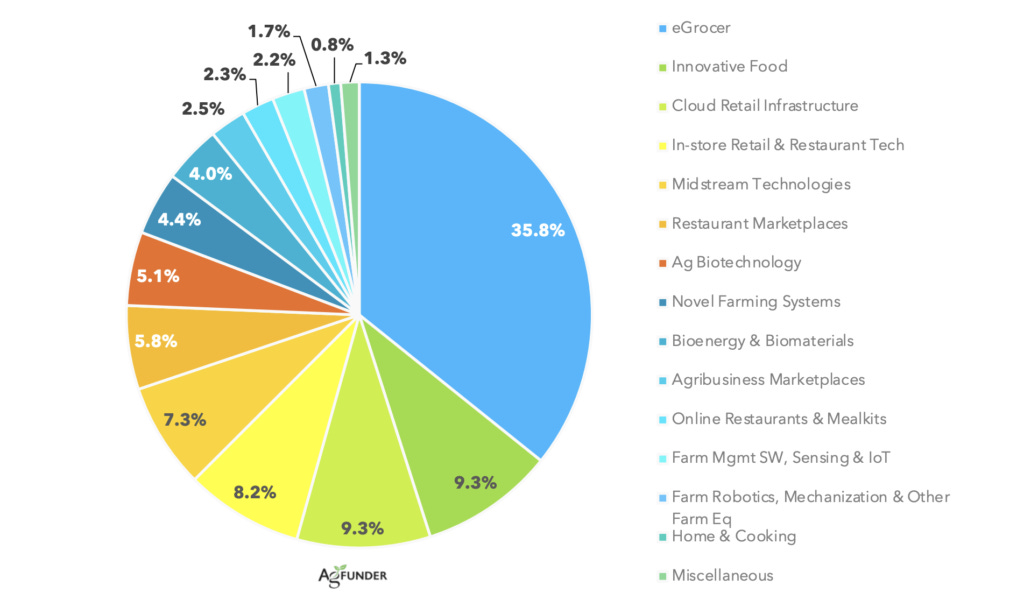

In 2021, e-grocery saw $18.5 billion in investments, claiming over 35% of all agrifoodtech investment for the year and growing 188% over 2020. AgFunder defines eGrocery as “online stores and marketplaces for sale and delivery of processed and unprocessed ag products to the consumer.”

“Prior to 2020, the eGrocery category was a “nice-to-have” rather than a necessity for most. The Covid-19 pandemic is frequently seen as the main driver for consumers adopting online grocery-buying habits. As AgFunder’s report notes, online grocery shopping is now “so engrained in consumer behavior that new entrants are building their brands around not just ‘convenient’ but near-instant delivery.” (agfundnews)

However, we recently learned that instant delivery company GoPuff is one of the first ones to hit the red line and face issues with their model.

4 - Restaurants should reconsider their investments and focus on their customers

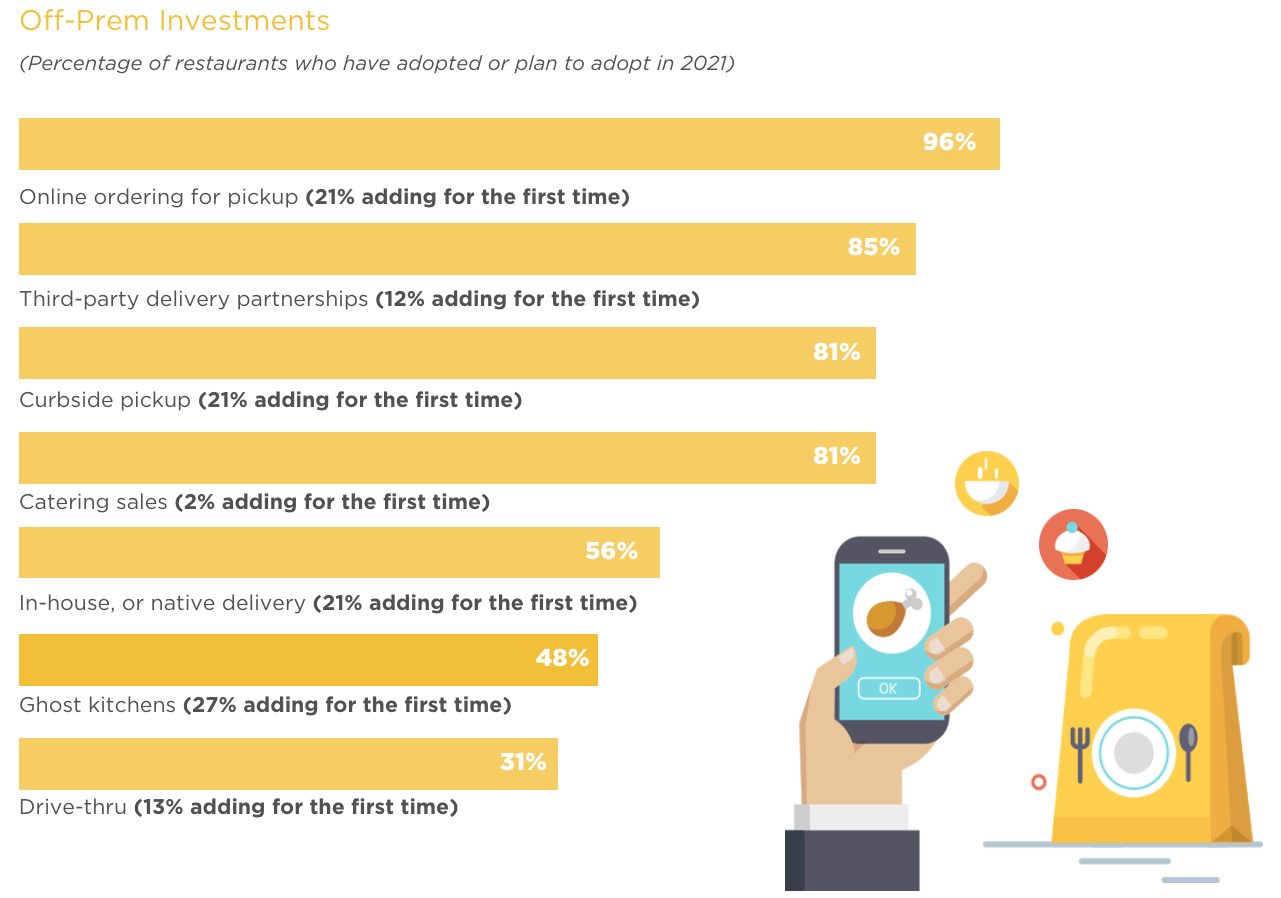

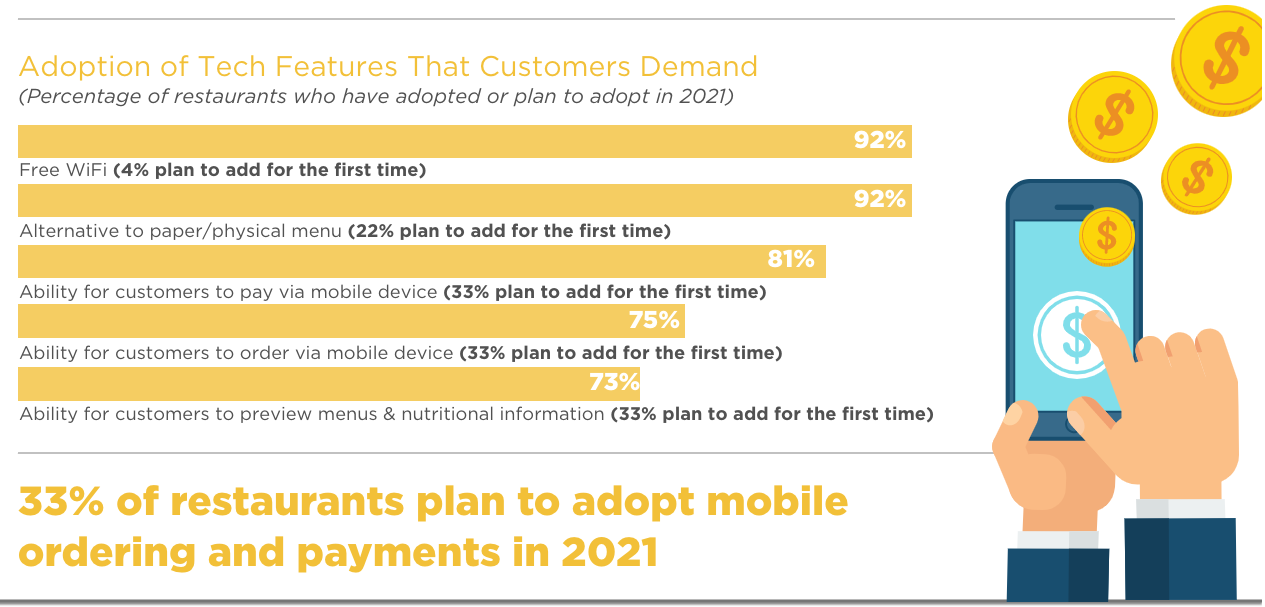

A recent Hospitality Technology study found in 2021 that the number one goal for restaurant tech investment is improving digital customer engagement.

While we've all had to adapt during the pandemic, restaurants that haven't evolved to this new normal may struggle to remain competitive. Think of the local mom-and-pop restaurant that only takes cash or doesn't accept digital contactless payment.

“Amid the pandemic, many restaurants quickly adapted to these demands, adopting interim or stop-gap solutions to lure hungry diners. As we begin the transition into a post-pandemic world, restaurants should re-evaluate their technology needs to ensure they address their customers' expectations across in-person dining, delivery and takeout – while still delivering a consistent guest experience”, writes Anthony Cross, Yelp's vice president of restaurant products.

Talk to me about these stories and what it means for your business!

The FoodTech Confidential Newsletter is supported in part by:

Stcavish + Co is an F&B market intelligence company, specializing in firsthand research and other data-driven information about restaurants, hotels, and more in China.

For information about our services, please contact stcavish@stcavish.com or see us on LinkedIn.

That’s it for now

As you can imagine, while doing my research, I am finding a lot more things that didn’t make the cut here (and some are going straight to LinkedIn). Let me know if you’d like to know more and drop me a comment, just reply to this email directly or contact greg@nextstepstudio.co.

Merci Greg pour cette newsletter, toujours très intéressant. On pense bien à vous tous à Shanghai, j'ai eu des news de ce confinement par d'autres amis en commun, pas facile cette situation, notamment pour dégoter de la nourriture !!! Bien amicalement, Antoine