🍙 FoodTech News with a $200 beer 🍻, another coffee ☕ chain entering China, and trying to understand what GEN-Z 💫 really really wants...

📣 Spread a little 💟 to support my work and leave a comment 💬 to start a conversation!

Hi, I’m Greg, founder of NextStep [F&B] Studio, we help brands and companies who need to learn about the new F&B trends & innovations from China and Asia. and see how this can help them.

The FoodTech Confidential Newsletter is my way to share what’s shaking the Food and Beverage industry with F&B professionals, FMCG experts, Tech entrepreneurs, and Investors with a focus on China, and, Asia.

Every post, here below, is full of links to various sources, visit them to know more about each particular topic.

I believe this should give you some ideas to get your business prepared for what’s to come.

🔄 Let’s talk about how we could help be ready for what’s to come! 🔄

🌶️ TODAY’S SPECIALS🌶️

1- 🛵 Food delivery platforms will have to rethink their business model

2- 💫 What does Chinese Gen-Z really really want?

3- ☕ Yet another coffee chain entering China…

4- 🍻 Do you think there is a market for a $200 USD bottle of beer?

5- 🌱 It looks like it is not easy to get people to switch to plant-based, but maybe it should start where the locals eat.

6- 🍜 Hundreds of millions of instant noodles are sold every year, but what if they could just be better for you, and the environment?

7-🧑🍳 Are you wondering how ghost kitchen businesses are reaching their numbers? Well, now, maybe (with this post), you could too!

8-🏅 There might be something better than loyalty points to keep your customers.

Now, let’s jump right in!

🔴 WHAT’S NEW IN CHINA?

1 - 🛵 Chinese authorities are forcing food delivery giants’ profit model to change in order to help restaurants.

Meituan 美团 and Eleme 饿了么 have been consistently raising fees on merchants but Chinese authorities have decided to force them to reduce the service fees charged to restaurants, in order to “help struggling service industries recover”. Food delivery platforms are also looking at improving their costs by reducing their reliance on manual labor (drones delivery, robots-chef,…), read the full article here.

2 - 💫 What makes Chinese GEN-Z tick?

Vogue Business in China has worked out a survey and got a pretty straightforward profile. The key takeaway for us, F&B people, is that Chinese GEN-Z consumers are careful about their spending (70%) and price-sensitive and less than 19% consider themselves as “trend followers”, but if there is something they love, they will go all-in. They are also looking for authentic marketing, and have a tendency to support patriotic products, which means that the” China chic” trend for Gen Z are products “that include “Chinese national elements”; those with “Chinese feelings and cultural confidence” or items that have an “Oriental aesthetic”. “ This goes way beyond a “Made in China” approach and foreign brands have a shot if they could gain “better understanding and interpretation of traditional culture”, get the full summary here.

3- ☕ Another premium coffee chain opens in China

After Hong Kong, South Korea, and Japan, Blue Bottle Coffee, the Californian premium chain, has opened its first location in Shanghai last week (and we just saw they will be opening their new location in Kerry JingAn, taking over Element Fresh’ spot who filed for bankruptcy recently). But as mentioned in our newsletter about the coffee they are entering a very busy market. We already talked a lot about Luckin Coffee in previous publications but it looks like the strong competition could come from Manner Coffee (and you don’t know them yet, here is a nice piece about "The Rise of Manner Coffee"). Even though Blue Bottle Coffee seems to be coming in with some cash, and is spending it on premium locations, let’s see if there is some room for them.

Do you want a hint about what I think? Refer to post #2 right before this post :) And let me know what is your take on this in the comment section.

4- 🍻 What about a premium beer gift-set priced over $200 USD?

You were probably not dreaming about it but Budweiser will be doing it anyway, and this will probably work… Indeed, AB InBev has over 50 beer brands in its portfolio including Hoegaarden, Stella Artois, Corona, and China-made Harbin (and “owns ~45% China’s market of premium and super-premium beer”). They already gave it a try with a gift box at 1,588 RMB and immediately sold out the 2,400 bottles (so did Tsingtao Brewery or China Resources Beer), and we saw how the limited editions work in our previous publication here.

🔵 WHAT’S HAPPENING IN THE REST OF THE FOOD-TECH WORLD?

5- 🌱 How to get people to switch to plant-based alternatives?

While plant-based products seem to have a hard time in gaining market shares in some markets (based on a recent report by KANTAR), EAT JUST decided to go down to the street level in Singapore and work with local chefs at iconic Singaporean hawker stalls (traditional street food stands) to launch dishes made with cultivated GOOD Meat chicken products across the island nation.

6- 🍜 Looks like the world could use healthier instant noodle options

We saw in recent publications that customer trends for 2022 are still all about healthier food and we also reported the interest in ramens and instant noodles as well. But since August 1958, when Japanese food company Nissin Foods released its first freeze-dried block of pre-seasoned ramen noodles, the first instant noodles, things have not evolved much. Since experts are still expecting the market to reach $72.7 billion by 2027 we can hope to see healthier versions (including more fiber, protein as well as vitamin, and less fat, carbs, or sodium) coming to the market like Future Noodles or Noodie.

7- 🧑🍳 Are you in the Ghost Kitchen business or wondering how this could work?

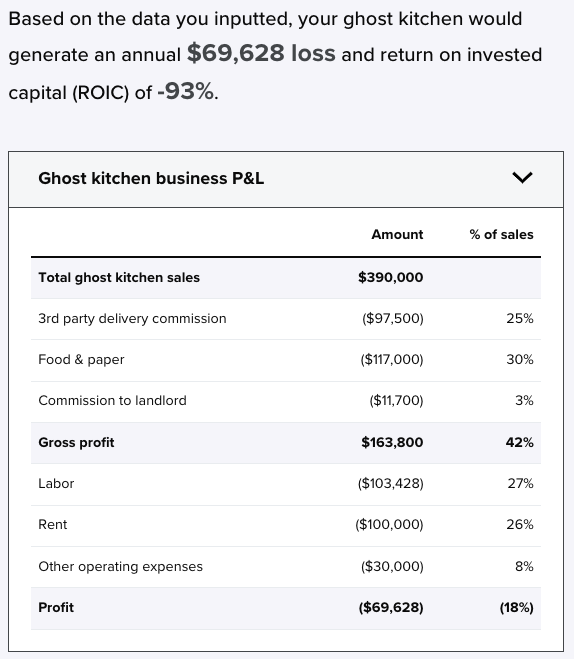

I recently came across this Ghost Kitchen Calculator introducing itself as “A calculator can help operators assess the financial profile and determine the feasibility of a ghost kitchen before developing their own concept.” This works for the US system but you can adapt it to your market too. See this example below.

8- 🏅 There’s more to building loyalty than simply offering rewards and incentives for consumers to buy again

A study conducted by Accenture across 25,000 global consumers shows that 50% of them had to rethink what’s valuable to them due to the pandemic. Of course price and quality are still ranking high as prime purchasing motivators, service and especially personalization are now getting equally important. For example, another analysis, also found that text marketing program subscribers visited 44% more frequently than non-subscribers. And, after joining a text marketing program, guests increased their frequency and spending by 23%. You can dig in the reports and find info you might need by visiting this article.

🔄 Let’s talk about how we could help your brand or company be ready with what’s to come from China and Asia 🔄

🔥 That’s it for now 🔥

As you can imagine, while doing my research, I am finding a lot more things that didn’t make the cut here (and some are going straight to LinkedIn). Let me know if you’d like to know more and drop me a comment 💬, or just reply to this email directly.

about Blue Bottle finally opening stores in China (Mainland), it will probably go as the saying "too little, too late". Based on the comments that Chinese users are leaving on Blue Bottle's 1st store in DaZhongDianPin (大众点评), many reviews are bad reviews, complaining about: the service, the prices (it makes Starbucks look cheap!), the quality & quantity of their coffees, the long waiting queues, etc. Only few comments are positive ones (which is strange for a company that is most likely paying a lot in marketing and branding to have positive reviews)... and also lacking of what you wrote on your post #2 : no "Chinese national elements" for the GEN-Z customers. Tough sell...