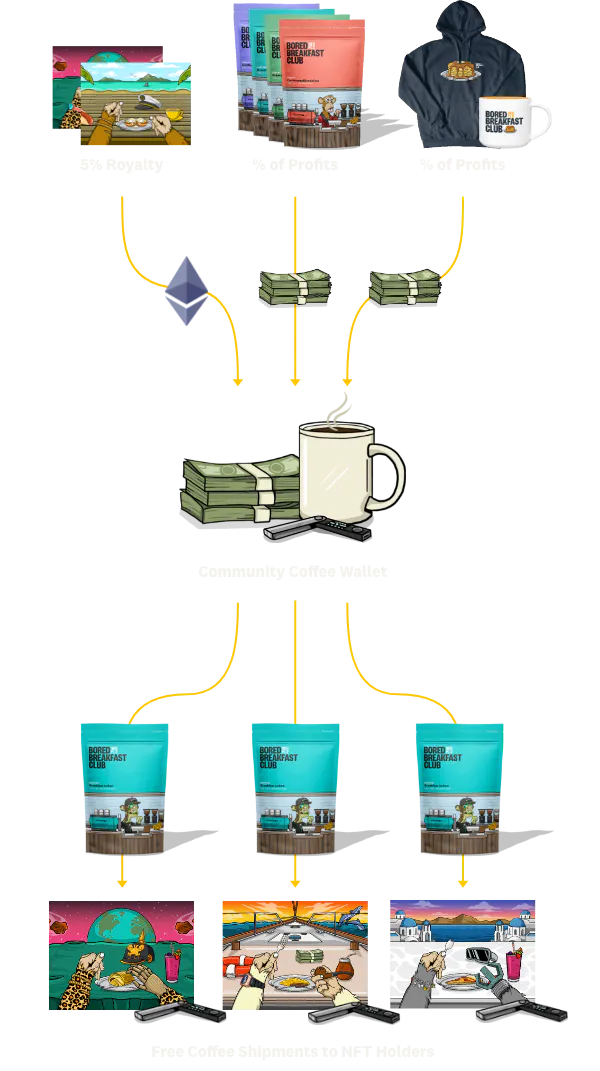

After the last newsletter about the use of NFTs in the F&B world, I had very interesting feedback. I will keep my eyes open in the Web3 space to see how you could use some of those ideas too!

This week, we are back to a press review with different topics I find interesting. I have added a link so you can request specific topics you’d like to know more about. So let me know!

On another note, Shanghai is supposed to get out of lockdown sometime this week (really). I will talk about it a bit below. For now, let’s see how and if things will return to normal!

— Greg

Hi, I’m Greg, founder of NextStep [F&B] Studio. We help F&B brands and companies in China grow by implementing new F&B trends & innovations.

The FoodTech Confidential Newsletter is my way to share what’s happening in the Food and Beverage industry with F&B professionals, FMCG experts, Tech entrepreneurs, and Investors focusing on China and Greater Asia.

Contact greg@nextstepstudio.co.

TODAY’S SPECIALS

China: Beyond Meat Launches Plant-Based Lunch Boxes Into 2,300 Lawson Stores

South Australian wine brand, Penfolds, to launch 'made in China' vintage in an effort to skirt Chinese tariffs

Bringing Ice Cream and Moutai Baijiu together

A Singaporean startup reinvents the instant noodle

Official statistics show F&B and hotel sales down 73% in April

How innovations in channels and scenarios are driving China's alcopop Market

Let’s dig in !

1 - China: Beyond Meat Launches Plant-Based Lunch Boxes Into 2,300 Lawson Stores

Beyond Meat will be rolling out two plant-based lunch boxes, including Beyond Pork and Beyond Beef, both produced in China. This represents a milestone for the brand in its expansion into the Chinese mass market.

“Beyond Meat has been progressively making inroads into the world’s biggest country, opening its cutting-edge production facility as well as a DTC e-commerce site. The alt meat giant has also announced high-profile food-service partnerships with Starbucks China and KFC.” Confirmed by Vegconomist.com

2 - Iconic South Australian wine brand Penfolds to launch 'made in China' vintage in an effort to skirt Chinese tariffs

Ningxia, in the northwest part of China, is a very promising wine region that is already getting lots of hype due to the great work done by many wineries there. Australian winemaker Penfolds has been producing wine in the region, which allows them to avoid the repercussions of China’s anti-dumping law.

“China's so-called "anti-dumping" tariffs imposed on Australian wine exporters in 2020 have devastated the market. The yearly value of Australia's wine industry has shrunk from $1.26 billion a year to $82 million.” recalled Abc.net and despite this,

This will be a good way to make wine in an Australian way and launch premium Chinese Penfolds by late 2022.

FTC note: This is not new. Many companies across the F&B industry spectrum have already made partnerships or M&A to localize their production (in part or total). This helps them avoid global instability and better control logistics cost.3 - Baijiu Ice Cream Chain by Kweichow Moutai Receives Chilly Reception

Early in May 2022, Chinese liquor giant Kweichow Moutai launched an ice cream shop called iMoutai in collaboration with Mengniu.

But something is wrong said RadiiChina. This luxury alcohol is traditionally consumed by male clients during business dinners. But here we are asking grown-up men to eat ice cream instead of drinking baijiu… Feedback is not great so far.

4 - A Singaporean startup reinvents the instant noodle

WhatIF Foods launched its noodles in Singapore in 2020, replacing the deep frying process used in conventional instant noodle production with a healthier method similar to air frying, but also making noodles from other types of crops.

“There are 300,000 edible plant species but in 2018, just four crops made up half of global production, and three — rice, maize, and wheat — accounted for 86% of all exports.

Christoph Langwallner, co-founder and CEO of WhatIF Foods, wants to change that. His startup is on a mission to diversify the food system with an environmentally-friendly crop that Langwallner says can restore degraded land, cut water consumption, improve our diet and increase food security: the Bambara groundnut.” reported CNN

The Bambara groundnut is a type of legume originally from West Africa and Asia, the same category as peanuts, peas, or beans, that is processed in Singapore and turned into “BamNut” flour to make noodles, soups, or shakes.

This could make a difference for farmers from arid areas if companies like WhatIF Foods could create global demand for this underutilized crop.

“According to the United Nations, 23 hectares of arable land are lost to drought and desertification every minute, and studies have found that aridity affects 40% of agricultural soil. Many areas of arable lands, where mainstay crops like maize have grown previously, are "no longer thriving" says Jideani. It's a major problem in Africa, where up to 65% of cropland is degraded.

But the Bambara groundnut is drought-tolerant and able to grow in poor soil in semi-arid regions while replenishing degraded land, offering an alternative crop that could help restore this land, says Jideani.” said CNN

5 - Official statistics show F&B and hotel sales down 73% in April in Shanghai

Following his previous report, our partner, Chris St. Cavish, reported on the impact of the city-wide lockdown imposed on Shanghai. And it’s not good…

But how did the city manage to generate RMB 3.6 billion in sales considering that everything was closed, and probably 95% of the people in Shanghai were in lockdown.

Chris says “It appears, as I speculated last month, that the figure may include the sales of hotels that were used to quarantine close contacts of positive Covid cases. […] It is also true that many hotels have guests who have been locked down like the rest of the city, including at least one five-star hotel in downtown said to have 100% occupancy.”

St. Cavish’s article includes more information and interviews with F&B operators who, even if this is going to be neither easy nor fast, remain optimistic.

And in the most recent (good) news, the city is planning to reopen by June 1st. It won’t be back to a fully normal operation, it won’t be the same for every business around the city either, and we can’t reasonably expect to have dine-in customers back inside a restaurant for at least a few more weeks. But…

Things are going to get better.

6 - How innovations in channels and scenarios are driving China's Alcopop market

Chinese consumers have been really into the low-alcohol beverage industry (less than 20% ABV), and investors too! (Even us at NextStep Studio — we have worked with seven different beverage brands in China during the past 18 months).

According to leadleo, the primary consumers of low-alcohol drinks are young women in first- and second-tier cities. Over 70% of low-alcohol beverage drinkers are 18 to 34 years old.

“Many attributes of the Gen Zers and female consumers overlap. For example, they prefer designs, flavors, self-pleasure, individuality, lower prices, less emphasis on brands or types, among others.

Of all these commonalities, price, however, seems to be central to consumer choices, at least according to some veteran industry insiders.” reports EqualOcean

Behaviors are also different with young consumers who would prefer consuming these drinks before bed, between female friends, and in the streets.

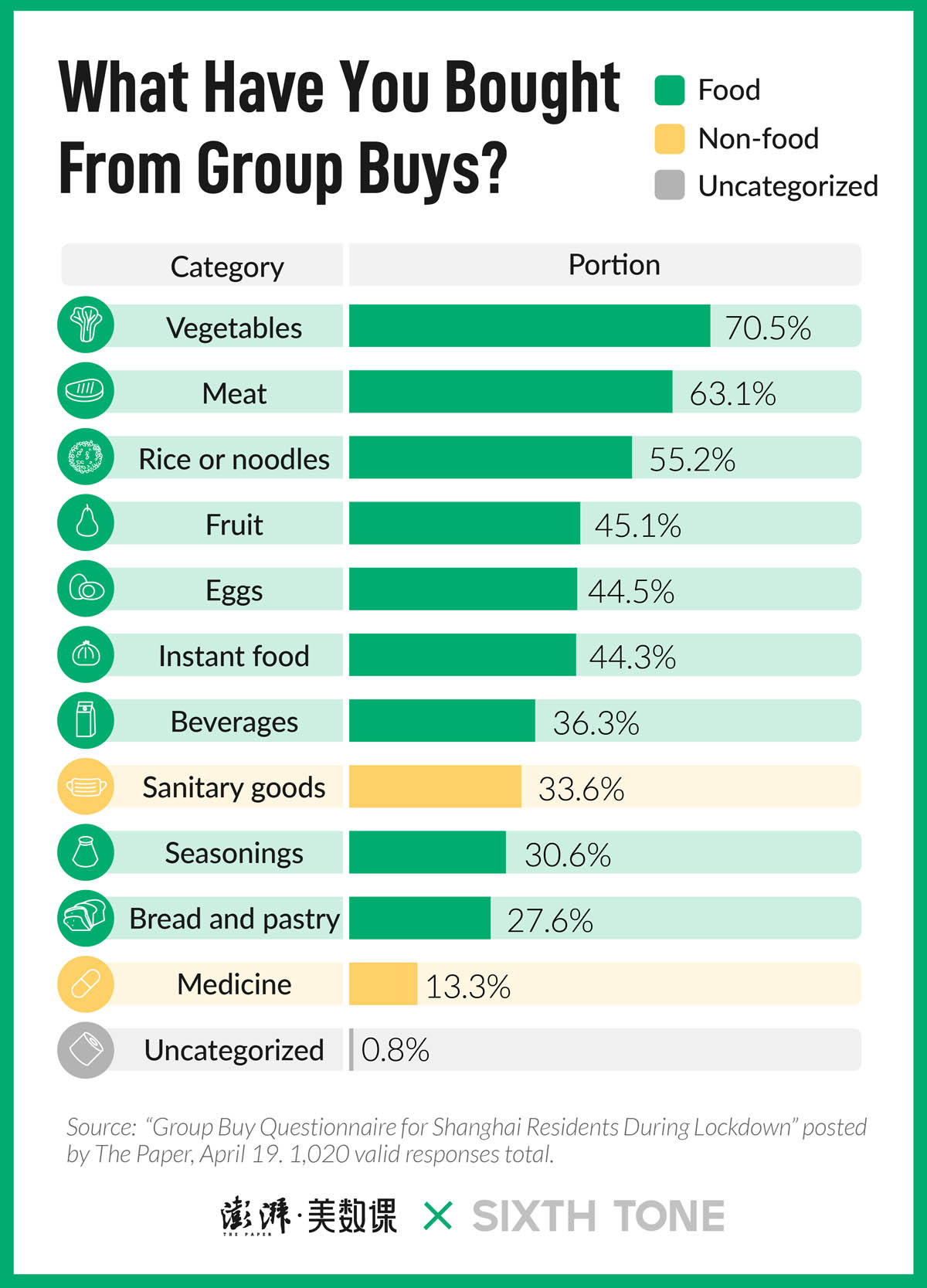

However, the current surge of the epidemic hit offline businesses hard, but sales are growing for home drinking with the group-buying wave.

Talk to me about these stories and what it means for your business!

The FoodTech Confidential Newsletter is supported in part by:

Stcavish + Co is an F&B market intelligence company, specializing in firsthand research and other data-driven information about restaurants, hotels, and more in China.

For information about their services, please contact stcavish@stcavish.com or see them on LinkedIn.

That’s it for now

As you can imagine, while doing my research, I am finding a lot more things that didn’t make the cut here (and some are going straight to LinkedIn). Let me know if you’d like to know more and drop me a comment, just reply to this email directly or contact greg@nextstepstudio.co

PS: I also have a little form to collect feedback and topic requests you’d like me to work on… it’s here! Take two minutes, this will help bring this newsletter to another level.